Internal sources of finance are funds found inside the business. For example, profits can be kept back to finance expansion. Alternatively, the business can sell assets (items it owns) that are no longer really needed to free up cash.

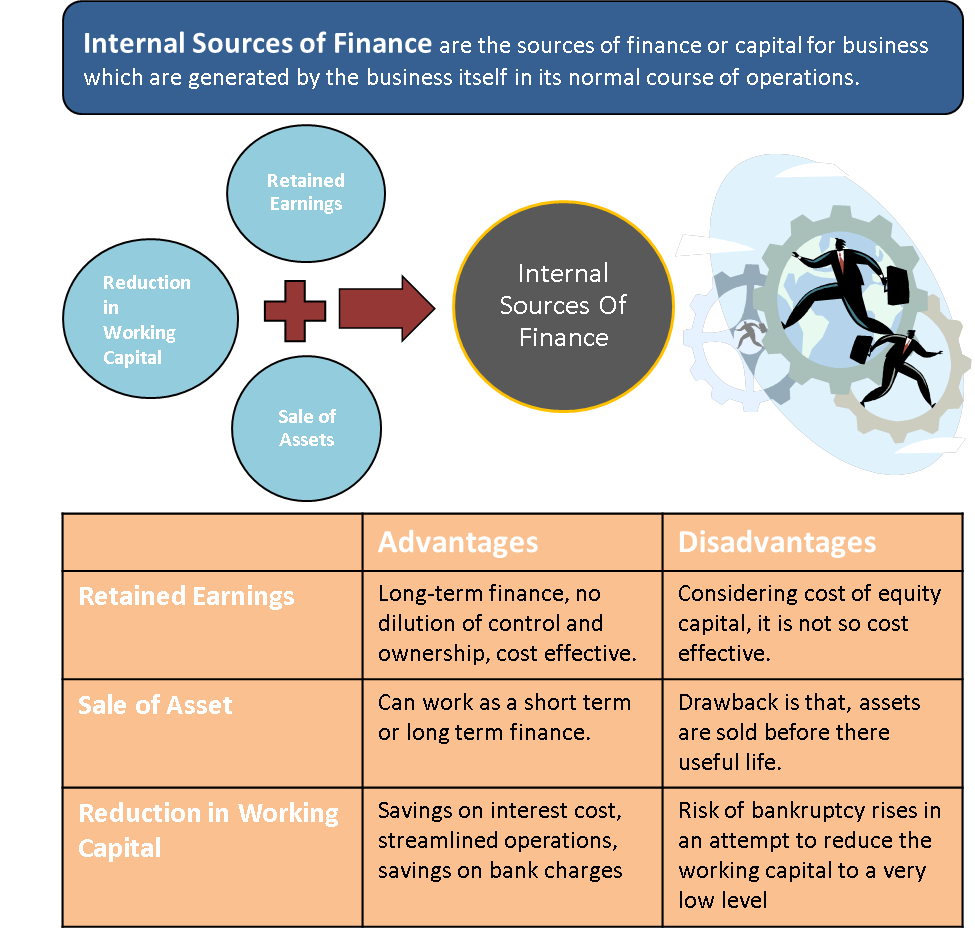

The term internal sources of finance itself suggests the very nature of finance/capital. This is the finance or capital which is generated internally by the business unlike finances such as loan which is externally arranged by banks or financial institutions. The internal source of finance is retained profits, the sale of assets and reduction / controlling of working capital.

Finance is a constant requirement for every growing business. There are several sources of finance from where a business can acquire finance or capital which it requires. But, the finance manager cannot just choose any of them indifferently. Every type of finance has different pros and cons in terms of its cost, availability, eligibility, legal boundaries etc. Choosing a right source of finance is a challenge. We need to have an in-depth understanding of the characteristics of the source of finance. Let us focus first on the internal source of finance/capital.

Internal sources of finance are the sources of finance or capital for businesses which are generated by the business itself in its normal course of operations.

The key characteristic is that there is no outside dependency for catering the need of capital. Internal sources of finance are:

RETAINED PROFITS / RETAINED EARNINGS

Retained profits/earnings are called the internal source of finance for a business for the simple reason that they are the end product of running a business. The phenomenon is also known as ‘Ploughing Back of Profits’. Retained profits can be defined as the profit left after paying a dividend to the shareholders or drawings by the capital owners.

FORMULA FOR RETAINED PROFITS

It can be stated as below:

Retained Profits / Retained Earnings = Net Profits – Dividend / Drawings

CHARACTERISTICS OF RETAINED PROFITS

Retained earnings are a long-term source of finance for a company because there is no compulsory maturity like term loans and debentures.

Retained profits are also not characterized by fixed burden of interest or installment payments like borrowed capital

Advantages and Disadvantages of Retained Profits as an Internal Source of Finance / Capital

ADVANTAGES OF RETAINED EARNINGS AS AN INTERNAL SOURCE OF FINANCE

The advantage of having retained profits/earnings is clearly seen in its characteristics.

- First, they are long-term finance and nobody can ask for their payments.

- Secondly, since there is no additional equity to be issued, there is no dilution of control and ownership in the business.

- Thirdly, there is no fixed obligation of interest or installment payments.

- Fourthly, retained earnings as an internal source of finance are cost effective considering the fact that there is no issue cost attached to it which ranges between 2 – 3 %.

- Lastly, investing retained earnings in the projects, with IRR better than ROI of the business, will directly have a positive impact the shareholder’s wealth and thereby the core objective of management will be served.

DISADVANTAGES OF RETAINED EARNINGS AS AN INTERNAL SOURCE OF FINANCE

There is practically no disadvantage to generating or using retained earnings for financing the investments of the business. Assuming that the funds generated internally are not free as they are the funds belonging to the shareholders and cost of these funds is equal to the cost of equity. There is only one alternative which can be explored i.e. debt financing. The purpose of exploring the option is to think on two points. One, financial leverage that can be gained by introducing debt financing. Second, if the leverage is possible and practical, dividend decision regarding using the retained earnings to pay dividends to shareholders can be explored.

SALE OF ASSETS

Another internal source of finance is the sale of assets. Whenever business sells off its assets and the cash generated is used internally for financing the capital needs, we call it an internal source of finance by the sale of assets.

ADVANTAGES OF GENERATING FINANCE BY SALE OF ASSETS

It can work as a short term or long term finance depending on what kind of assets are sold. Say, selling a car can cater short term and smaller finance needs and selling land, buildings or machinery can cater to long-term and bigger finance needs.

Secondly, it is a good idea to regularly screen the fixed asset register and find assets which are no longer in use or are already obsolete etc. These assets should be sold as early as any of such event happens so that dilution in the value of such asset would be less.

DISADVANTAGES OF GENERATING FINANCE BY SALE OF ASSETS

A major drawback of this type of capital is when the assets are sold before their useful life. Apart from loosing on the services provided by the sold asset, there is a loss in the form of capital loss due to the asset being sold at scrap value. A possible and perfect solution to that situation is ‘Sale and Lease-Back’. It is a type of lease under which we can get the required cash and at the same time use the asset under concern in exchange for a lease rental. With this option, the business may end up paying more money in the long term but current finance problem can be solved.

REDUCTION OR CONTROLLING OF WORKING CAPITAL

It is interesting to know how a reduction in working capital can work as an internal source of finance. Working capital has broadly 2 components. One, Current Assets, which include Stock / Inventory, Account Receivables – Debtors and Cash / Bank Balances. Second, Current Liabilities, which include Account Payables – Creditors and Bank Overdraft.

HOW TO GENERATE FINANCE BY REDUCTION OF WORKING CAPITAL?

Normally, a business requires two types of finance viz. long-term finance for capital expenditure and working capital finance for day to day needs. Reduction in working capital can be achieved either by speeding up the cycle of account receivables and stock or by lengthening the cycle of account payables.

SPEEDING UP ACCOUNTS RECEIVABLES

Trade credit is an unavoidable event for any business barring a few. A finance manager should make strategies to speed up the collection of money from accounts receivables.

LENGTHENING OF ACCOUNTS PAYABLES

Negotiating good terms with accounts payables can finance part of the trade finance required for customers.

In essence, both will reduce the working capital requirement and therefore the funds invested for working capital can be utilized for the other finance or capital requirements. This source has a little different analytics. This source is generated out of the efficient management of working capital and appropriate usage of working capital management techniques.

ADVANTAGES OF REDUCING IN WORKING CAPITAL

The advantages of reducing the working capital manyfold. The primary benefit is savings on the interest cost paid on working capital loans, bank overdrafts, cash credit etc. Some of the many secondary benefits which are achieved while in the process of reducing the working capital are

- Offcourse, savings on interest cost

- efficient overall working capital management,

- streamlined operations of the business,

- savings on bank charges, etc.

DISADVANTAGES OF REDUCING IN WORKING CAPITAL

Risk of Bankruptcy

Although, it is difficult to locate any disadvantage of reducing working capital, a risk of bankruptcy rises in an attempt to reduce the working capital to a very low level. So, we recommend optimizing the working capital in place of reducing. You may consider reading following:

Optimal Working Capital

The internal source of finance is broadly covered under the above heads. Some other types of finance which are termed as an internal source of capital are the employee contribution to the financial requirements of the company and the personal savings of the owners.

Most of the times, a finance manager would try sourcing funds from internal sources because of the benefits as stated above. Businesses using an internal source of financing also shows a sign of good performance as the business is independently satisfying its requirements with the help of its own efficiencies and operational profits.